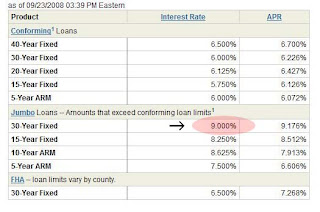

Note that jumbo loan rates are currently lower than fixed rates in North Carolina. Jumbo loans are riskier for lenders because more money is at stake, as such they come with higher interest rates.

Conforming loans can be re-sold on the secondary mortgage market and they qualify for normal interest rates. If you need to take out a home loan in North Carolina that exceeds the conforming loan limit in that particular county, you will be taking on what is considered a jumbo loan. North Carolina county conforming loan limits are set at $726,200. The average North Carolina rate for a fixed 30-year mortgage is 5.83% (Zillow, Jan. You can also get a 15-year fixed-rate mortgage which will allow you to pay off your debt quicker and you will pay less interest but your monthly payments will be higher. It is a very reliable option because the interest rate remains the same for the duration of the loan which makes it easier to budget for monthly payments. Buyers have 30 years to pay off this loan unless they make prepayments or decide to refinance. If you are buying a home in North Carolina, the first home loan option you need to be aware of is a 30-year fixed-rate mortgage. 30-Year Fixed Mortgage Rates in North Carolina A quality home inspection gives you the peace of mind of knowing your home isn’t harboring any secrets that could cost you thousands down the line. The purpose of these disclosures is to protect buyers, but a home inspection is always a smart idea to protect the integrity of the sale. This list should include information on the plumbing, electrical, water supply source, environmental conditions like asbestos and any homeowners’ association fees and services. North Carolina state law requires home sellers to provide buyers with a disclosure form listing details on the property. While you are probably not planning to buy a home with the intention of going into foreclosure in the future, it is best to be aware of where you stand and what you can expect if your circumstances were to change for the worse. Homebuyers in the state will likely get a deed of trust which allows lenders to bypass a judicial foreclosure and instead initiate a power of sale foreclosure by simply hiring a third party to auction the home. Lenders in North Carolina typically do not have to go to court to foreclose on a home when the owner has fallen behind on payments.

0 kommentar(er)

0 kommentar(er)